Table of Contents

ToggleAttractions have the ability to draw tens of millions of people annually through their gates and completely change the economies of cities and states. In effect, our industry is the study and harnessing of, massive tourism flows.

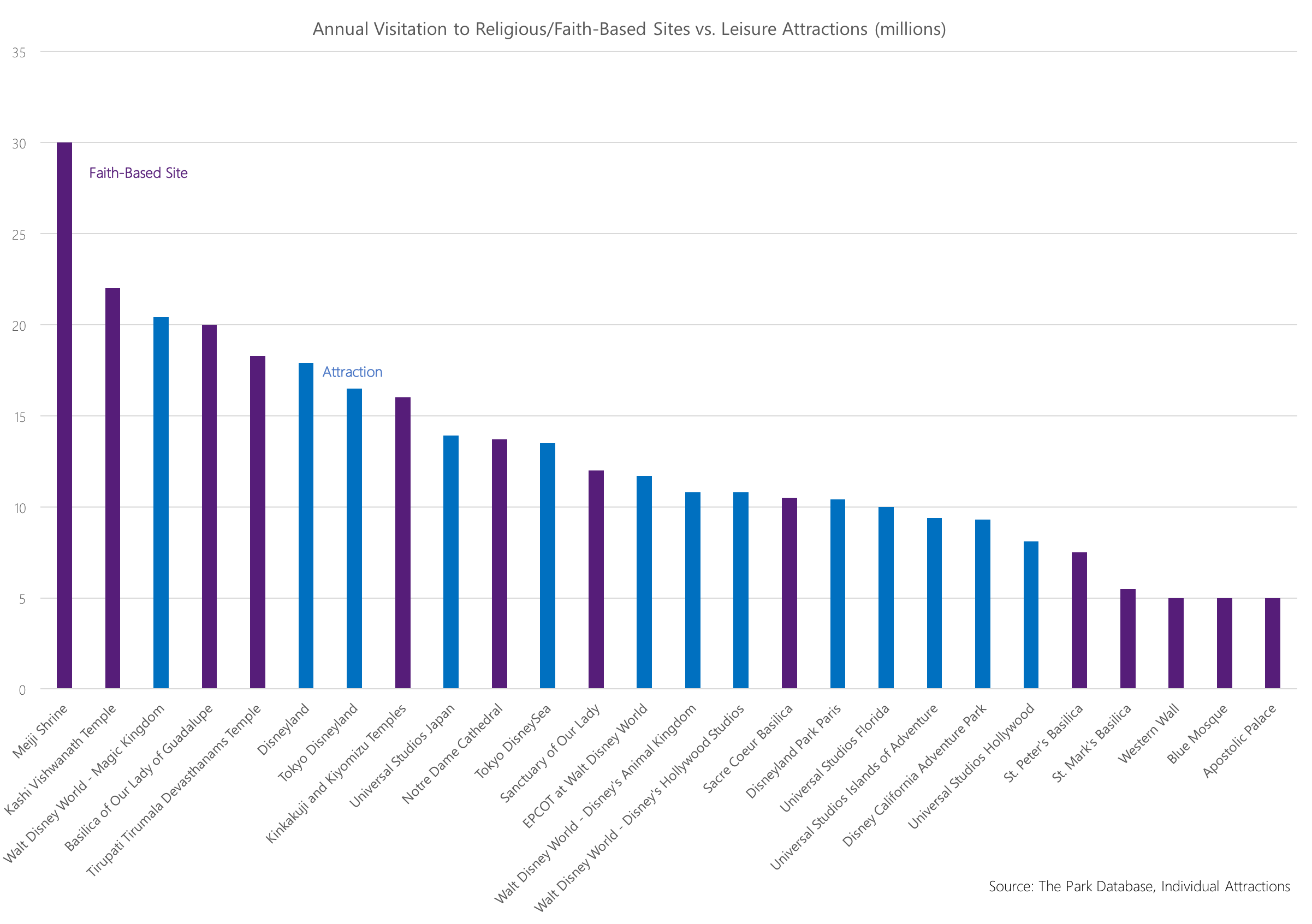

This is no surprise. But, what may be surprising is that even the largest themed attractions pale in comparison to the religious travel “market”, if we can call it that.

High Visitation

Visitation driven by faith; pilgrimages, or visits to temples, churches, and mosques, experience volumes that would be enviable to any attraction operator, with volumes into the 10-30 million range.

Economic Impacts

Religious visitation has cascading economic impacts because of nights booked in nearby accommodations, sales of food and beverage as well as souvenirs, and other ancillary spending.

This is a concept that Walt Disney understood well when he developed Disney World in Orlando, which famously sought to extend the length of stay on Disney properties from 7 hours, in the case of Disneyland Anaheim – to 7 days.

Religious tourism and pilgrimages experience the same dynamic. One of the most prominent examples is visitation to Vatican City, where the Vatican’s budget shortfalls are made up by tourism and souvenir/stamp sales, which in total account for more than $100 million in revenues, and approximately $60 million in profits.

Saudi Arabia

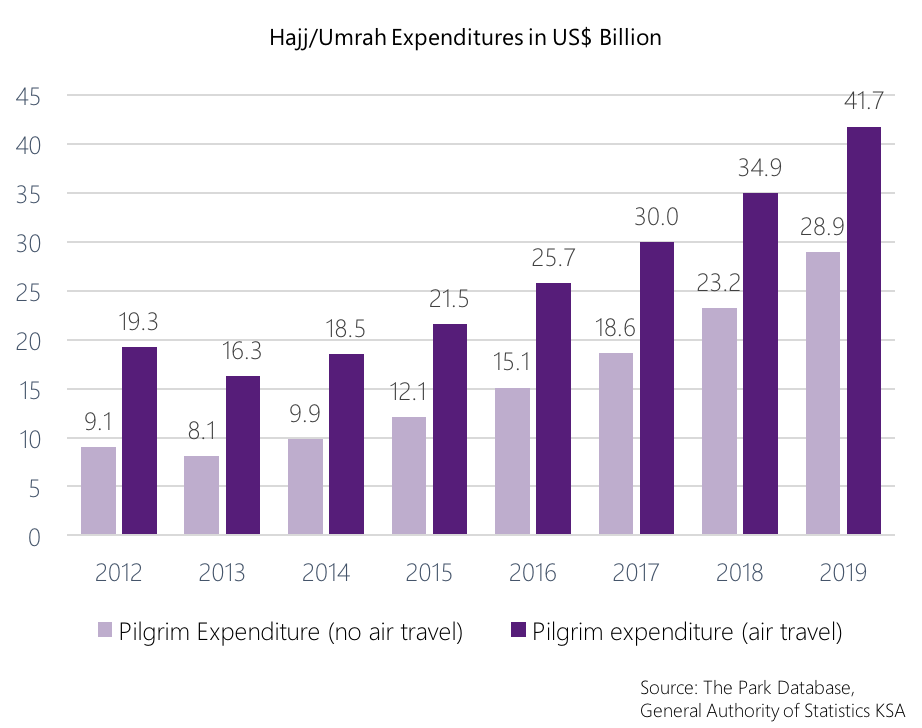

But by far the biggest, most mind-blowing religious pilgrimage impact in the world are Hajj and Umrah* in Saudi Arabia. Accounting for over $20-30 billion in revenues worldwide (much of it accruing to Saudi Arabia), the pilgrimage to Makkah, which is required during the lifetime of devout Muslims, has no peer in the travel and tourism industry.

You might note that $20 billion is more than the GDP of many countries!

*While both Hajj and Umrah refer to the pilgrimage to Makkah, in Saudi Arabia, by Muslims. However, Umrah can take place anytime during the year, while Hajj takes place only during specific days during the last month of the Islamic calendar.

An Emerging Destination

Saudi Arabia is quite a germane topic these days in the tourism and travel industry.

Among other developments, the ride park operator Six Flags has announced a first ride park in Riyadh, which has set off a flurry of interest in other parts of the country, such as on the Gulf Coast and King Abdullah Economic City. Add to this the recently announced Vision 2030 plan, which has, among other announcements, hinted at the relaxing of visa regulations, and resort development along the Red Sea coast, and Saudi Arabia has been a market to watch.

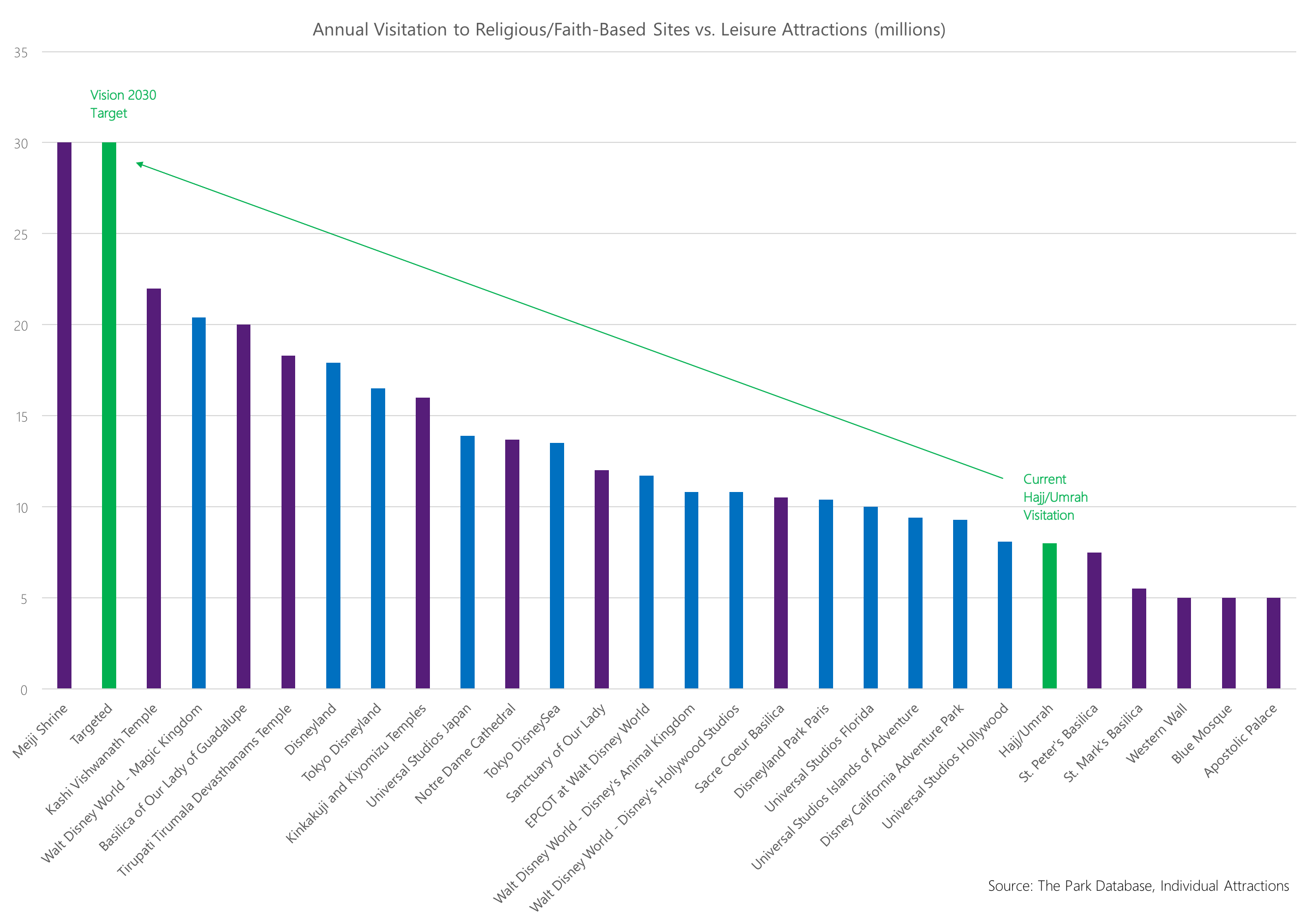

But – leisure developments notwithstanding, Hajj and Umrah still dominate the Saudi tourism landscape. Foreign pilgrims account for more than 8 million visits annually, and religious pilgrimage occupies a central tenet of the Vision 2030 program, which seeks to increase these numbers to 30 million by – you guessed it, the year 2030.

Engagement

Our Analytics team recently had the chance to work with the Saudi developer Manara for an opportunity relevant to this whole discussion.

The core question we were tasked with was: if there was a potential Islam-themed private tourism destination developed in Saudi Arabia, what would be the scope and nature of the economic opportunity? What would such an attraction look like?

Religious Travel in Saudi Arabia

While we can’t share all the details, here are general observations that we hope you’ll find useful.

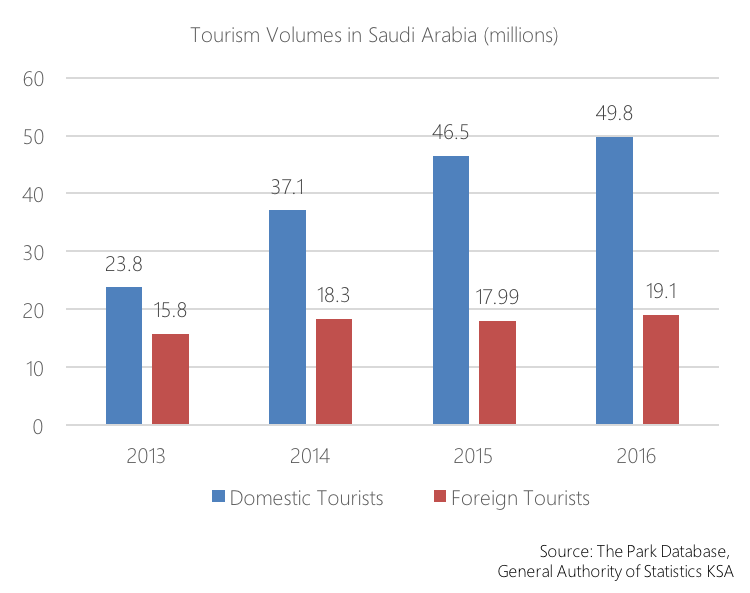

- As staggering as the pilgrimage industry for Hajj and Umrah are, the domestic Saudi tourism market outnumbers international tourists by a factor of 2 to 1 – more than 50 million domestic trips taken during 2016! Indeed, this is a phenomenon that didn’t go unnoticed by our Client and others we interviewed on the ground. Due to limited things to do within Saudi Arabia, many Saudis (too many, according to some), leave the country for other tourism options. Herein lies a massive opportunity.

- Over half of foreign tourists to Saudi Arabia are arriving for the purposes of religious pilgrimage – Hajj or Ummrah. The rest arrive for purposes of visiting friends and family, business, or other reasons.

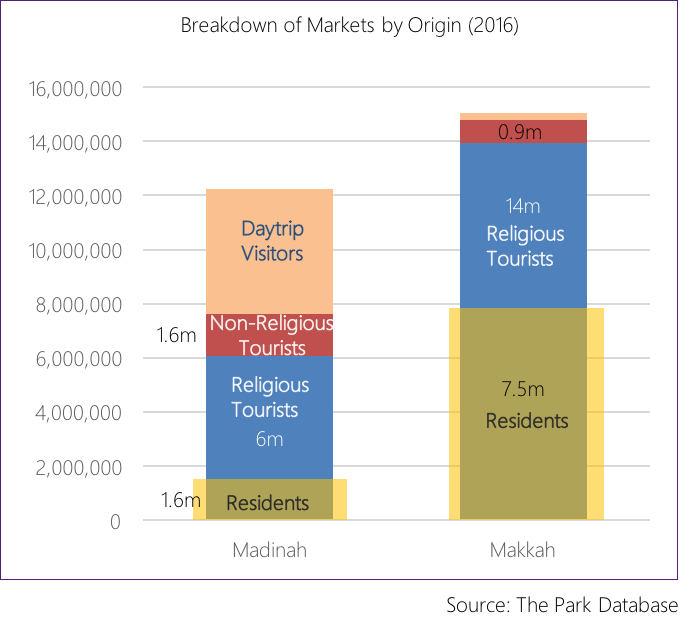

- Makkah and Madinah are the two likely cities for a potential Islam-themed attraction, as they are the two essential stops on any itinerary for pilgrimage. Of the two destinations, Makkah has the significantly higher resident population (7.5 million versus 1.6 million) and receives a much higher volume of tourists (14 million pilgrims versus 6 million for Madinah). For these reasons alone, with all else being equal (i.e., land cost and availability), Makkah is the obvious choice.While Madinah does not appear to be a mandatory stop on Hajj/Ummrah itineraries, Makkah definitely is.

- While Umrah visitation takes place as a controlled flow throughout the year, Hajj is extremely seasonal and would cause nightmares for any traditional attraction operator. With a peak month ratio for visitation of between 25-30%, and with day-of-month peaking of 5%, this translates into design day ratios of over 1-1.5%. While these might not be the highest design day ratios in the world (here’s looking at you, China Golden Week), the monthly seasonality is unparalleled, and results in hotel occupancies that are at full occupancy during Hajj, but between 30-40% during the rest of the year. This is all to say that sizing will be a nightmare.

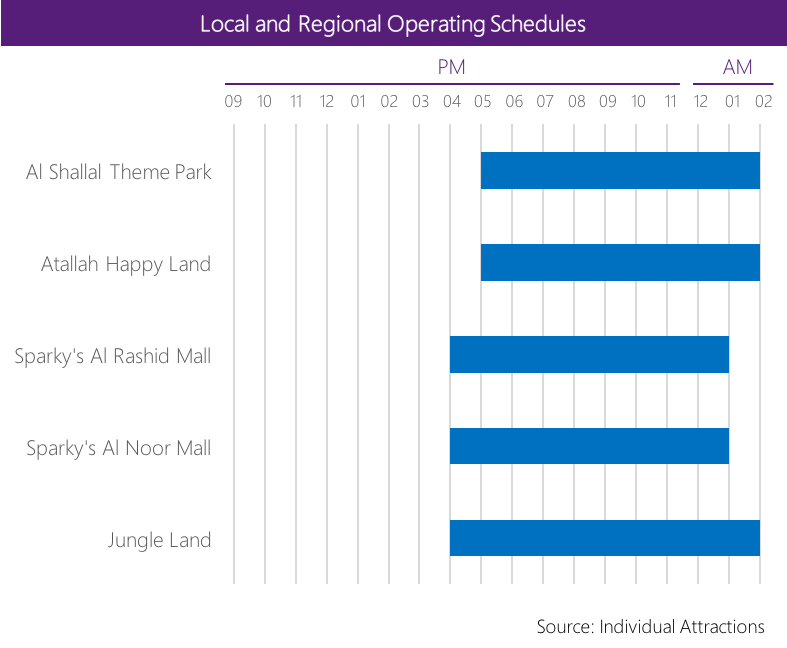

- An interesting feature of attractions in the Middle East, and Saudi is no exception, is the fact that the high heat skews opening hours. Instead of operating on schedules that open shortly before noon and close in the evening, attractions usually open at mid-day and close past midnight.

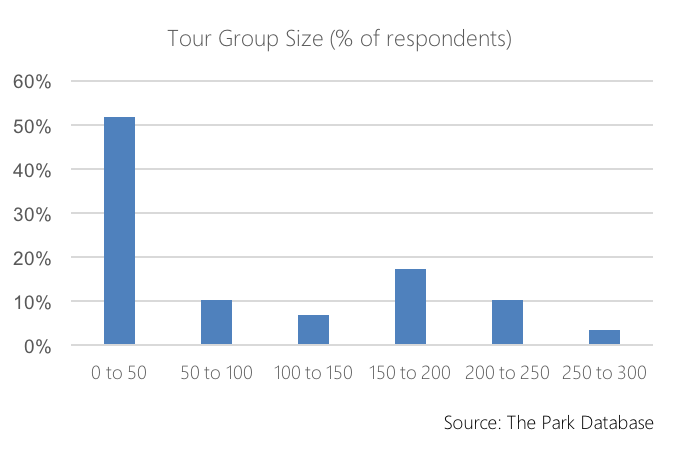

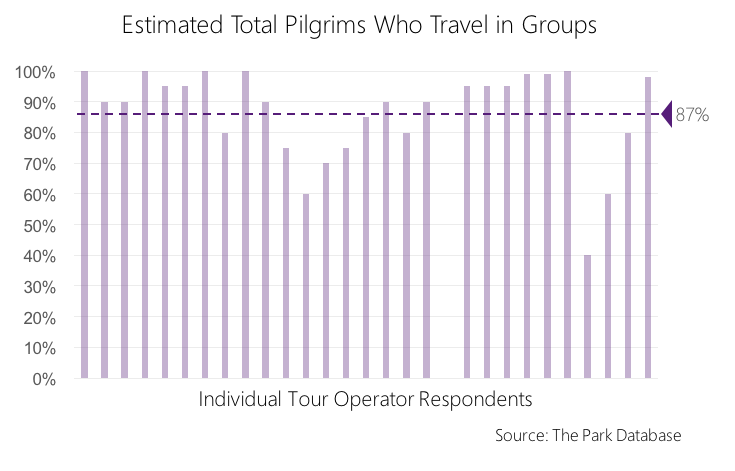

- Pilgrims to Saudi Arabia arrive predominantly in tour groups. This is significant, as it impacts how they travel, where they go, and how much they are willing to spend. While exact statistics are not available, based on our interviews, we estimate that 80-90% of pilgrims travel through licensed tour operators, rather than as independent travelers. These pilgrims purchase tour packages from the operators directly, and are subject to relatively fixed itineraries. This means that tapping into this market source, which is significant, has to be through the tour operators themselves, with perhaps some global marketing.

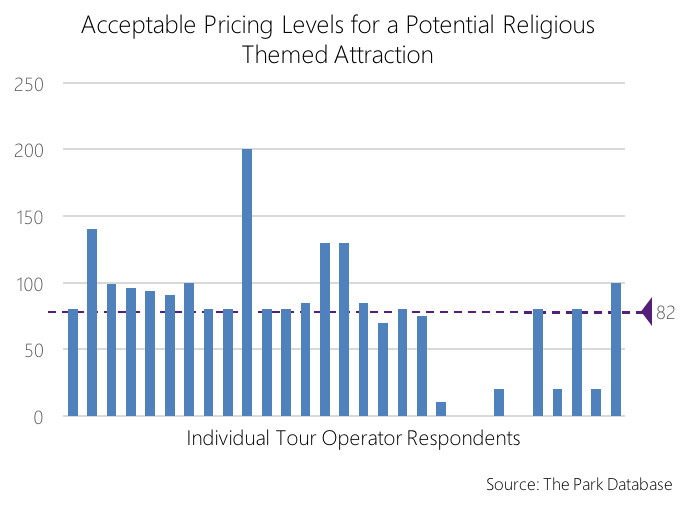

- Tour operators that we interviewed indicated an average level of approximately 80 SAR for a religious-themed attraction. Many pilgrims are from developing countries, and operators from these countries initially pushed back against the idea of a paid attraction. Although when pressed, operators from Pakistan and India indicated acceptable pricing of between 0 and 25 SAR. The outlier on the graph below (200 SAR) is from a tour operator located in the United States.

For more information about the Manara project, and any questions at all, please contact our Analytics Team.