Table of Contents

This post is a brief primer of the indoor theme parks of the world along the lines of revenues, size, visitation, and development costs.

This is a broad category that benefits from further segmentation, as it spans 1,000 sqm playrooms to 100,000 sqm mega theme parks in their own right, such as the Warner Brothers Abu Dhabi. It’s such an extremely large range that it often makes little sense to refer to the entire category as a monolith, as many do. Hence this post!

Introduction

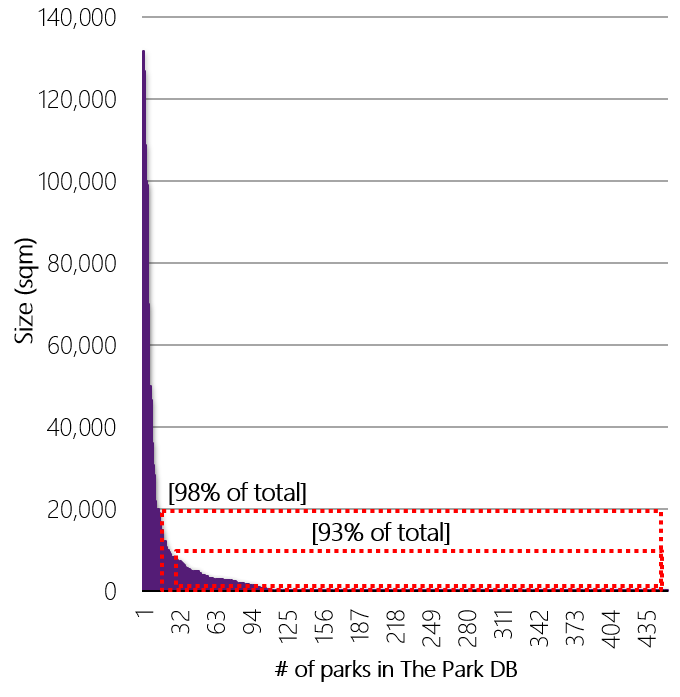

Despite the extremely large range, the vast majority of indoor theme parks are less than 20,000 sqm. In fact, one can count on two hands the number of notable indoor theme parks that are larger than this: Warner Brothers Abu Dhabi, Lotte World, Trans Studio, Nickelodeon Universe, Ferrari World Abu Dhabi among them.

Why is this the case? Any indoor park larger than 20,000 sqm is essentially a large theme park that happens to be indoors for whatever reason. Whether it’s for purposes of seasonality (located in a climate with extreme cold or heat) or because the park is repurposing the use of a large indoor space, such as an airplane hangar or space inside a gigantic mall.

And there simply aren’t that many 20,000 sqm boxes laying around ready to be used, especially when the costs of a theme park-ready shell can be as costly as the actual attraction itself. Asif Parkar, Vice President of Themed Entertainment at Cumming, advises that the “cost of the big box to put traditional theme park boxes inside of ranges from $350 to $500 / sf*.”

When this is the case, a 20,000 sqm purpose-built box can be upwards of $70 million alone!

In summary, 98% of indoor attractions and parks are less than 20,000 sqm, and ~93% are less than 10,000 sqm. The latter is the size range of park we’re covering in this post.

Categories

Just as zooming into the world with a microscope reveals a fractal universe, zooming into the indoor park category also reveals a staggering range of concepts.

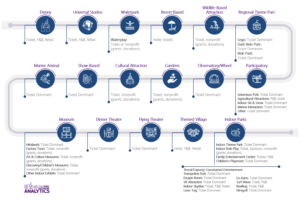

For lack of a better means of segmentation, we would categorize indoor parks into these loose clusters.

- There are the indoor parks that are specifically targeted at young children, rather than the entire family. In these categories, adults are expressly forbidden to participate in the same activities as children: these are represented by the Playrooms and Edutainment categories in the map above.

- There are the active play parks, which span the range of trampoline and adventure parks, go karting attractions, indoor skydive, laser tag, etc., and overlap considerably with the “eatertainment” category such as Dave & Busters and Topgolf, which are social entertainment experiences that derive a major portion of their revenues from F&B.

- We reserve a separate cluster for the emerging category of VR/AR attractions.

- The cluster of attractions in the interactive exhibit category (“Exhibitainment”/Interactive above) spans Instagram museums, immersive theater attractions, and attraction museums, such as Ripley’s Believe it or Not and Madame Tussaud’s.

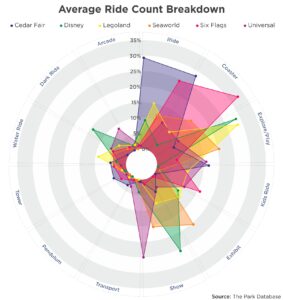

- By far the largest category by count would be the Arcade category (despite the dearth of logos above). These are the traditional FECs with an arcade core surrounded by various elements from the other categories, whether smaller rides, active play elements, playrooms, or F&B (such as the former Chuck E Cheese’s.)

- And then there are the traditional parks that happen to be indoors, heavily ride- and arcade-driven. These are larger.

Note that these clusters are not perfect, and there is abundant overlap.

Sizing

Indoor parks are constrained by both their size and the nature of the experience: entire categories of parks are timed, putting a cap on the number of people who can experience the attraction at any one time. Think go karts, kid’s city concepts, bowling, golf, indoor skydiving, etc.

Even in the absence of timed limits, these experiences are also often constrained due to space. Indoor spaces start to feel crowded before outdoor spaces do, and the principles of good experience design dictate that there are maximum density ratios in planning.

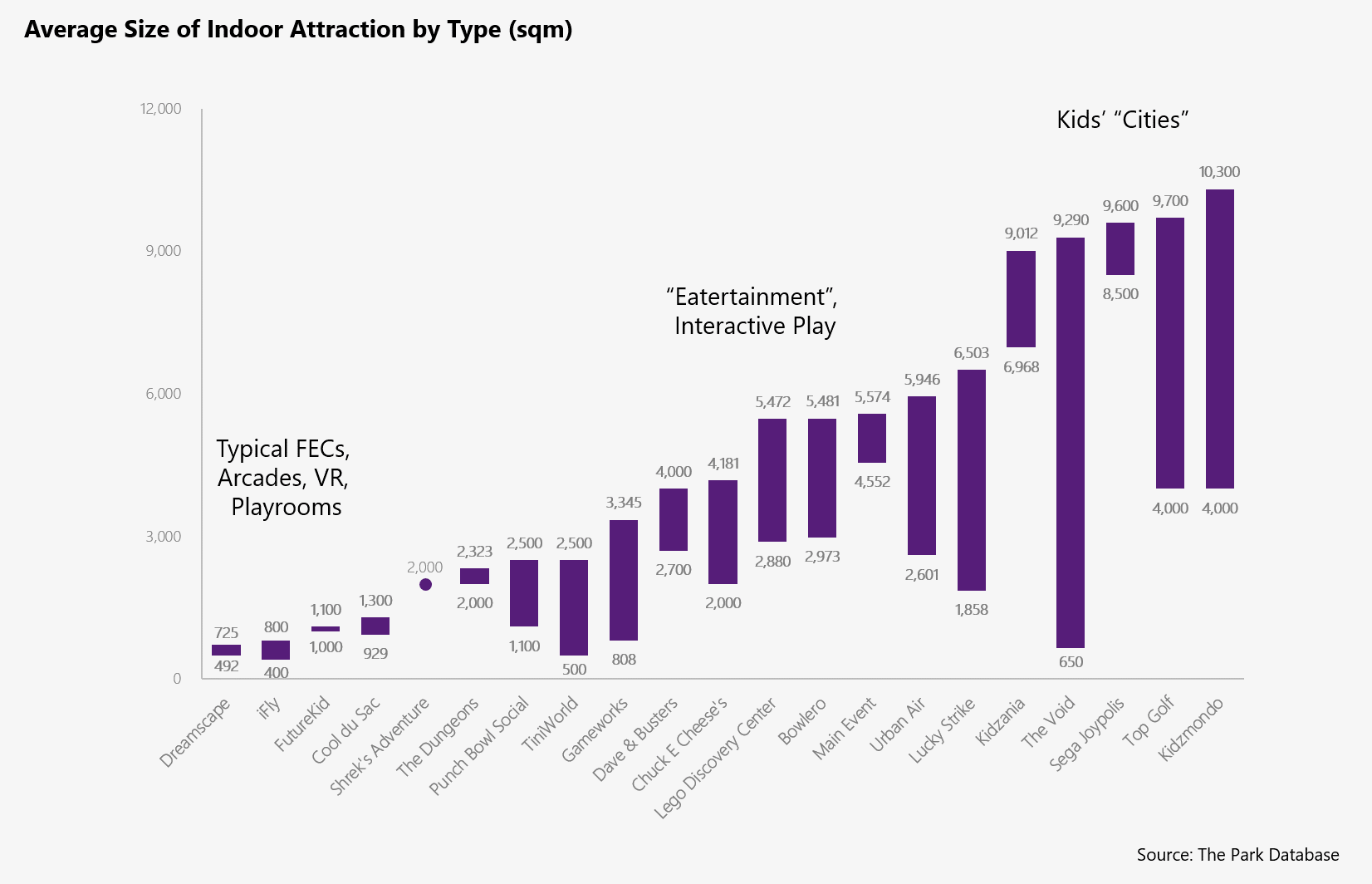

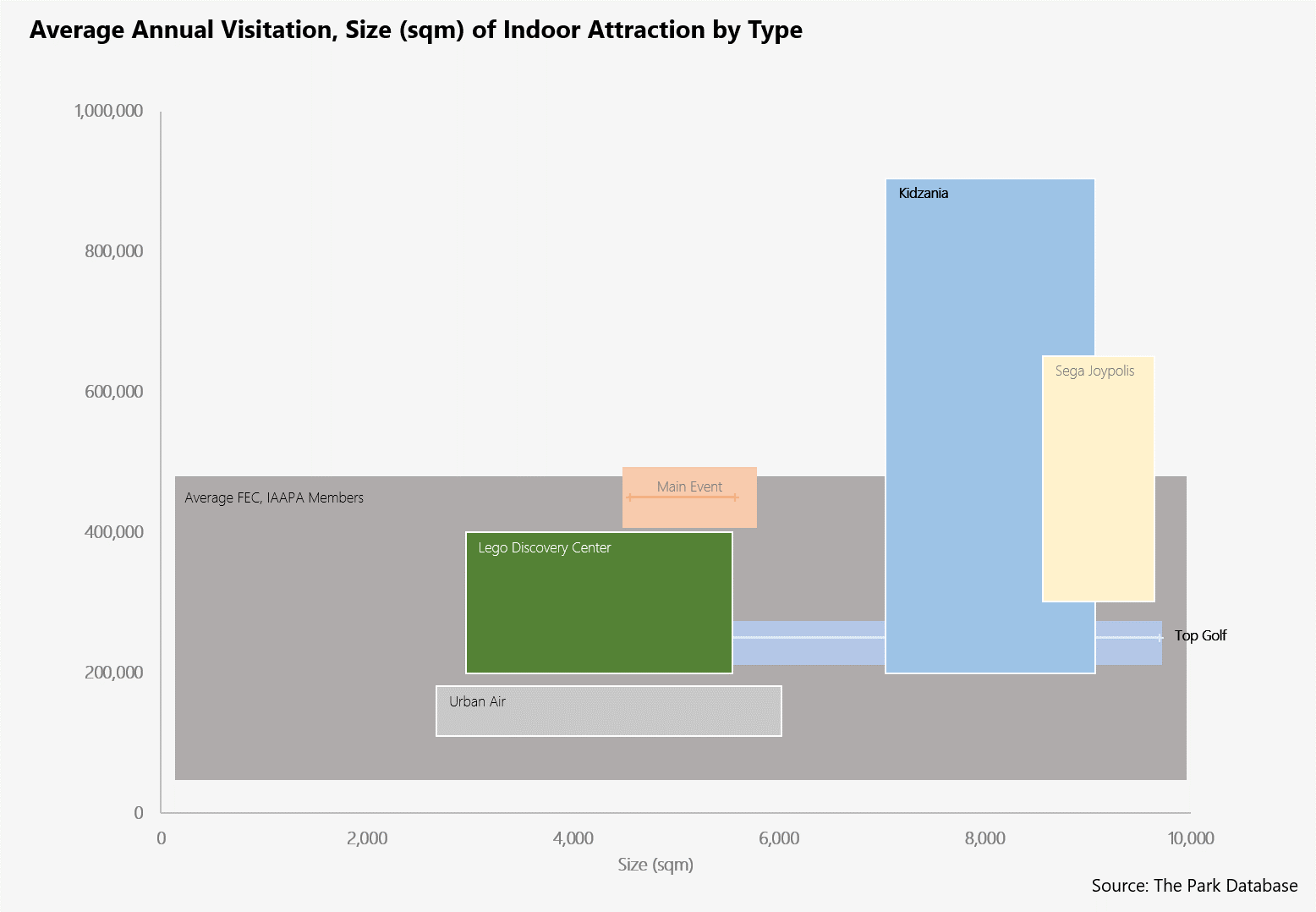

Because of this, most indoor parks of the world tend to be less than 10,000 square meters, with distinct sizing bands.

Strict timed attractions, such as VR and indoor skydiving concepts are less than 1,000 sqm, while playrooms, exhibitions and childrens-oriented centers average between 500 to 3,000 sqm. Meanwhile, a solid band of 3,000 sqm to 7,000 sqm concepts account for most of the categories in this survey: active play, adventure parks, eatertainment, and edutainment.

Why do we start with sizing first? Because sizing constrains topline measures too – visitation, revenues.

Development Costs

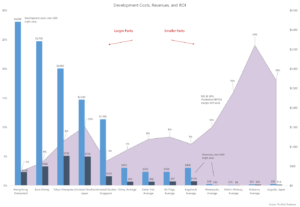

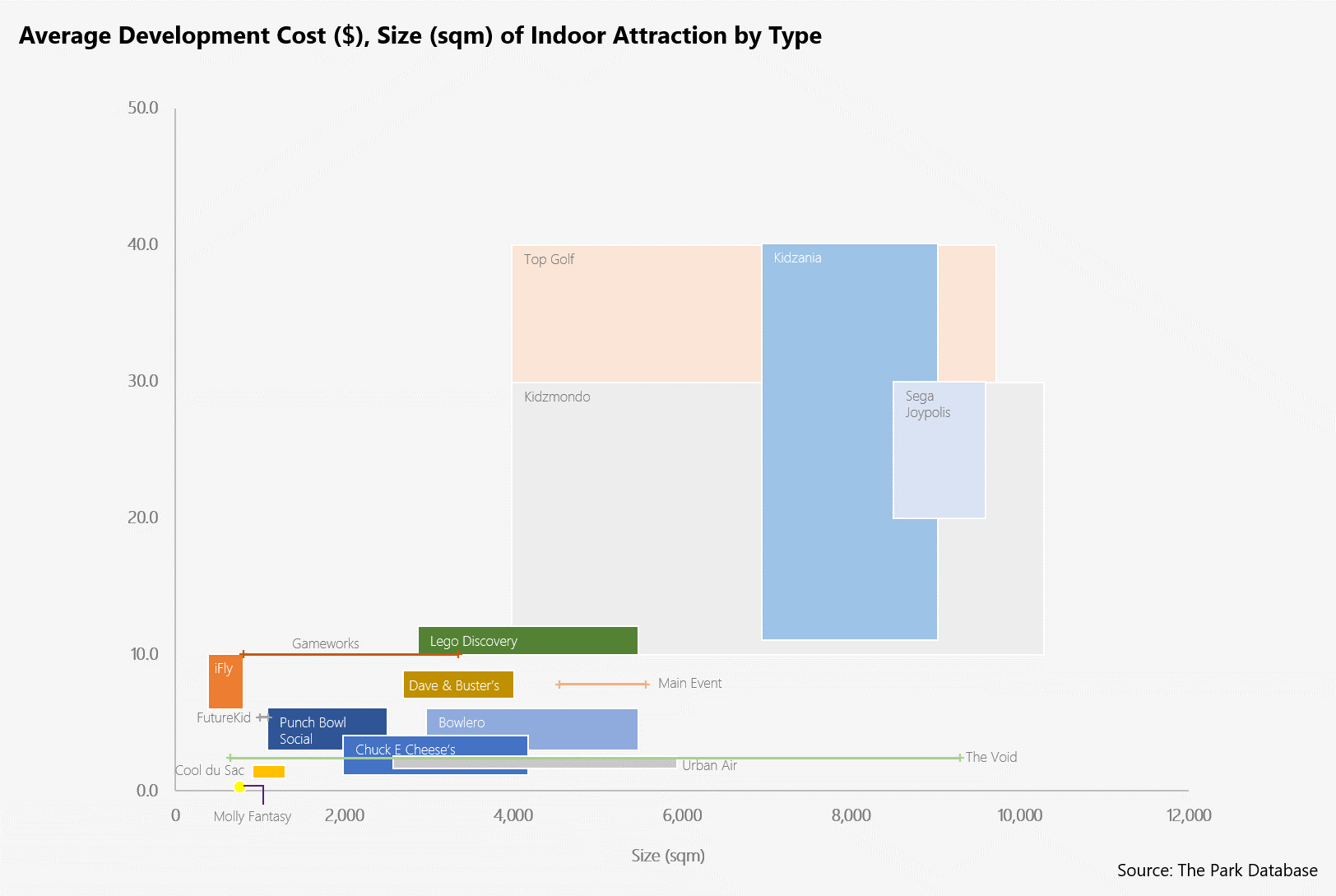

As sizes are constrained, so are development costs. Here the story is in the outliers. While most indoor entertainment concepts are less than $10m in budget, the largest are $30-40 million USD.

Note that these are not necessarily correlated with size, but also with theming and experience design – a Kidzania attraction can be the same size as a Dave & Buster’s, but will be several times the development cost due to the complexity of the theming.

Revenues

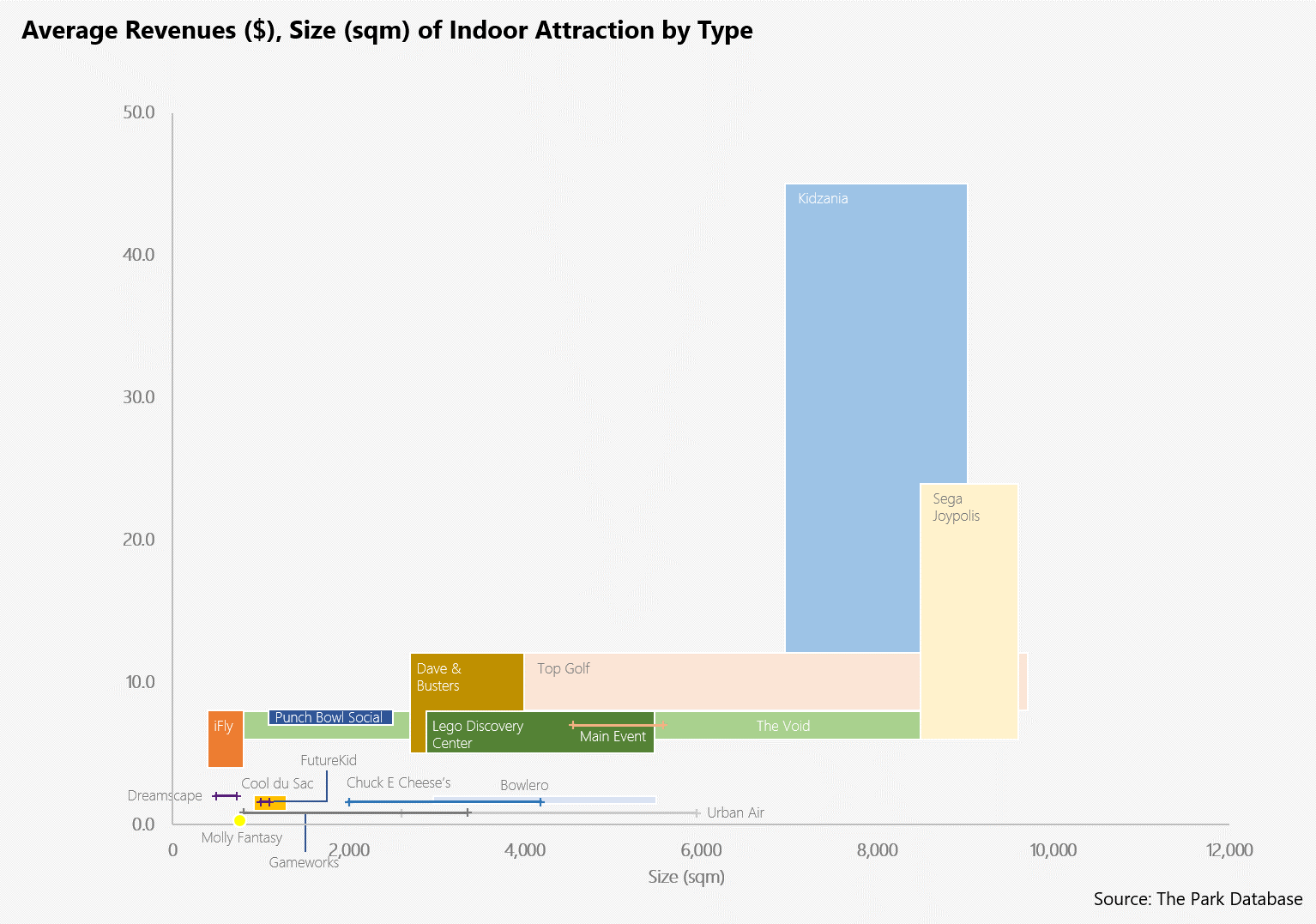

Revenues are a similar story.

The top indoor parks in this survey (those less than 10,000 sqm) exhibit revenues of between $20m and $40m. In this illustration Kidzania is a clear outlier because of its ability to draw on sponsorship revenues (30% of total), which give it a clear advantage over competitors.

However, revenues in the world of indoor parks is constrained for the majority; average revenues at the top performing chains are between $5 and $12 million.

Visitation

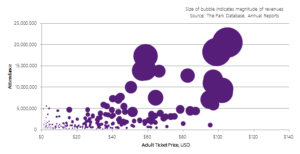

Despite its staggering range of concepts, our primary point in this post is to point out that the performance range for indoor parks is a lot more constrained than at their outdoor equivalents.

Top theme parks of a certain size (300,000 sqm+) can range in visitation from 5 million to over 15 million, a 3x increase in range, and in revenues from $100 million to many billions (a 10-20x increase in range).

In contrast, visitation at top performing indoor entertainment concepts top out at between 300,000 and 500,000. It is a truly remarkable indoor park that generates even close to 1 million in attendance, and the ones that skirt this bound are simply, larger.

Summary

To any developer, these ranges should give one some targets to aim for. Difficult but informative questions to ask are the following:

- Will it be possible to break $10 million in revenues (average in this set) in a 5,000 to 7,000 square foot space? Unless you are a major chain, this is uncommon, so what are the reasons why?

- In your plans, are you targeting an attendance number that is 300,000 (average), or 800,000 (quite high)? If the latter, what is the reason for your confidence?

- Will the space be a timed experience? If so, look for higher per capita revenues but lower visitation: are you over- or under-sized relative to these requirements?

- How will you deliver a differentiated experience in a constrained space?

For more ranges of the core assumptions that go into a theme park or attraction model, don’t miss our planning tool.

*This figure reflects the hard costs of construction and comprises the following:

- The steel frame that provides the structure for the big box

- Roof finishes (which is offset a little some because the boxes inside do not need to be weatherproof)

- Enhanced foundations to support loads for the larger box

- Exterior cladding for the box (the boxes inside do not need to be weatherproof)

- Lighting to the now enclosed space

- Mechanical considerations within the large box (moving air at a minimum)

- Architectural and show treatment inside the box including to the underside of the roof, possibly secondary ceiling, mural, hanging props etc.