In the last decade, China has gone from being an attractions backwater to one of the world’s most significant theme park and attractions markets. But perhaps more than in any other market in the world, China’s theme park industry is extremely bifurcated, with what we can call top-tier, world-class theme parks on one end, and government-supported zombie operations on the other. It’s unlike any other market in the world.

In this post, we review visitor characteristics at the big three megaparks in China:

- Shanghai Disney Resort

- Universal Studios Beijing

- Chimelong Ocean Kingdom.

Shanghai Disney represents Disney’s largest investment to date in a single resort (nearly $6 billion in total), and its newest development overall. Universal Studios Beijing is also the brand’s latest and most expensive theme park endeavor. Chimelong is China’s premier homegrown attractions brand, and Chimelong Ocean Kingdom the larger of the company’s two resort operations in Guangdong.

Chimelong Ocean Kingdom was long-rumored to be the nation’s highest-attended theme park, but it was impossible to validate this claim – until now.

We’ve been working with various big data mining and research companies in China to obtain visitor characteristics at attractions in the country. When we set out on the engagement, we had muted expectations about what kind of data would be available.

What we discovered was mind-blowing. With the help of mobile phone location services data, GPS, and wifi tracking, we were able to track the movement of 95% of all cell phone and mobile devices around the country, precise down to the exact building, and the exact hour during which the building was visited.

With statistical extrapolation from the range of installed apps and self-reported settings on the mobile device, we were also able to obtain demographic and socioeconomic data, including information on gender, income levels, occupation, and automobile ownership, just to name a few.

It’s not only the level of detail that was surprising; the data was completely eye-opening.

Findings

A summary of the 2023 results for Shanghai Disney Resort, Universal Studios Beijing, and Chimelong Ocean Kingdom.

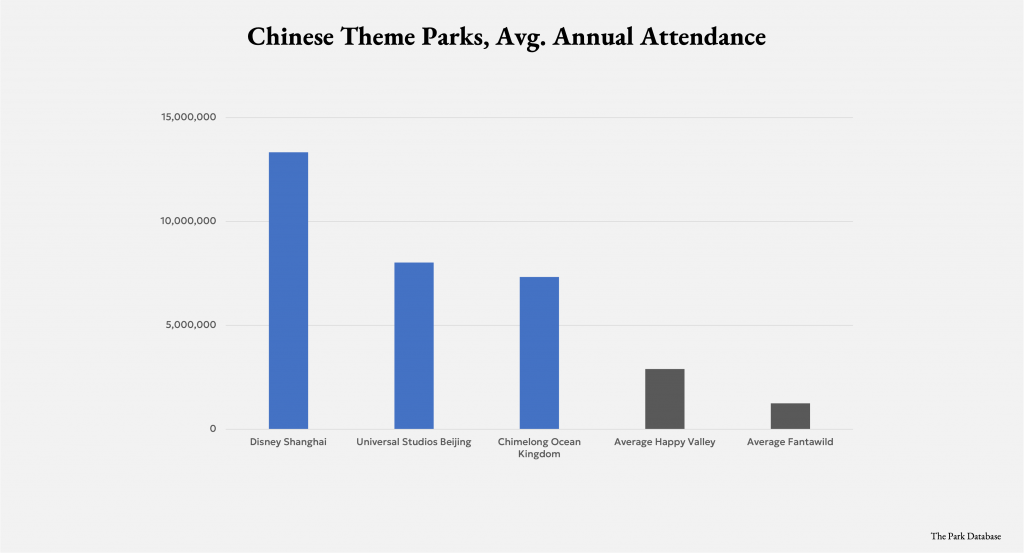

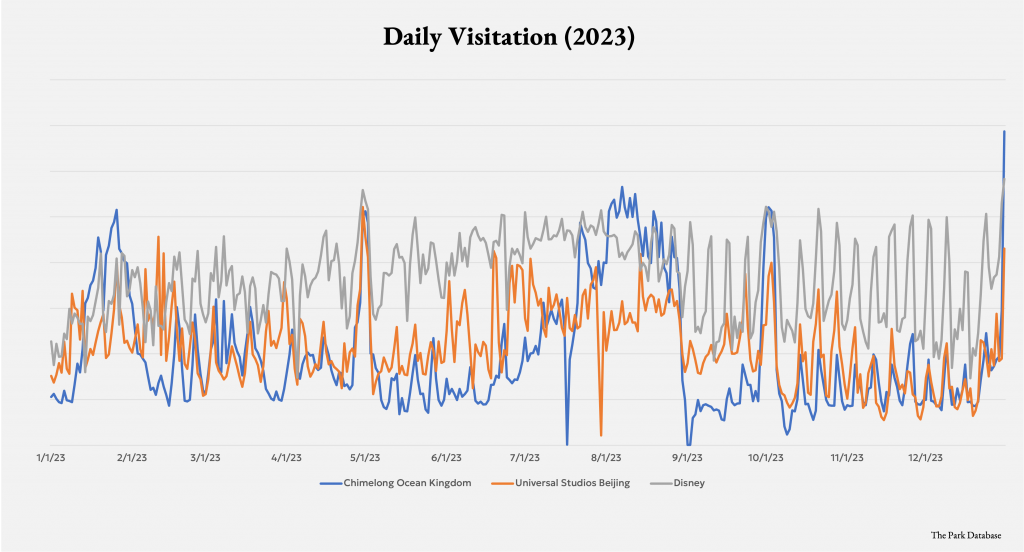

- In 2023, Shanghai Disney hosted 13+ million annual visitors, while Universal Studios Beijing and Chimelong Ocean Kingdom each hosted between 7-8 million. In order of attendance from highest to lowest, they are Disney, Universal Studios, and Chimelong.

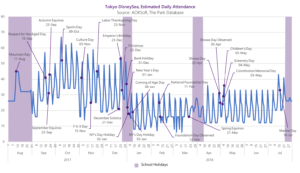

- Peak seasonality is not necessarily during the Golden Week holidays. These data undercut the typical understanding that the Golden Week holidays are the busiest for parks in China. New Year’s Eve is actually the highest attended day for both Chimelong Ocean Kingdom and Shanghai Disney, while all parks see local peaks during the Spring Festival as well.

At regional and local theme parks in China, we often see design day ratios during Golden Week approaching nearly 2% (as expressed in average daily peak attendance to annual attendance). However, at all three megaparks, the design day ratios are well under the standard 0.7-0.8% used in planning most parks, and are instead remarkably well-distributed throughout the year. We interpret this as a sign that all parks are quite operationally efficient, and able to distribute attendance via price elasticity of tickets and other marketing schemes.

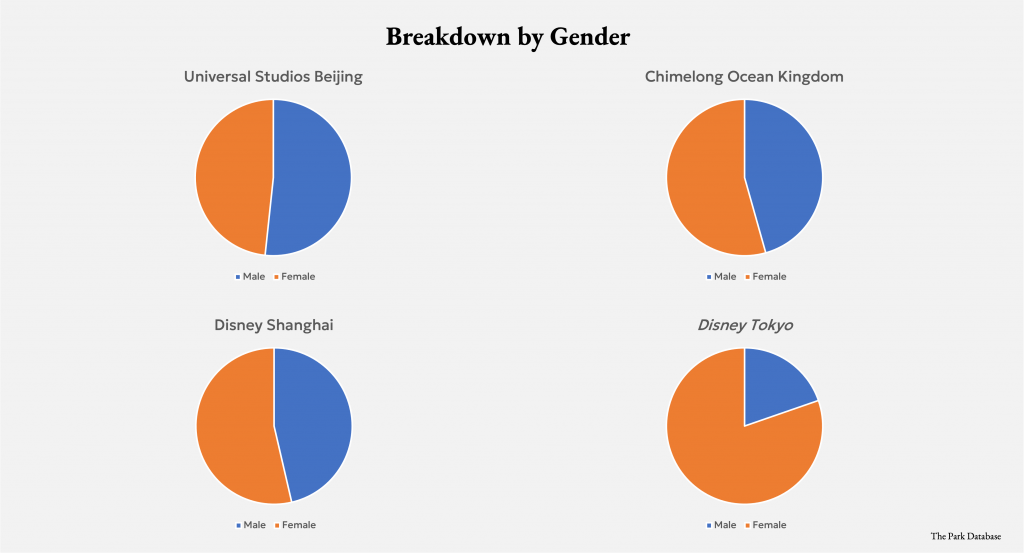

- At both Shanghai Disney and Chimelong Ocean Kingdom, the majority of parkgoers are female. Universal Studios Beijing sees the opposite trend, with a majority male audience. This trend has been remarkably consistent; for both Shanghai Disney and Chimelong Ocean Kingdom, this gender breakdown has remained stable since 2018, which is when we first took this big data snapshot.

- This echoes trends in other mega parks in the region; Tokyo Disney’s visitorship has been over 70% female for decades now. While Shanghai Disney and Chimelong are not yet at those levels, it seems possible they could veer in that direction.

- Visitor origins to the park are well-distributed. Neighboring regions account for less than 50% of visitors, meaning that nearly half of visitors are likely overnight tourists. This phenomenon can be interpreted in various ways; perhaps the lack of world-class theme parks in China means that there is an overwhelming flow of overnight visitors over residents to these attractions. This is contrary to the long-held understanding that theme parks in metropolitan areas derive a significant majority of their visitors from the local resident market.

With this wealth of data, China has gone from being the world’s most opaque market, to the world’s most transparent, in a sense. Business planning for any location-based project in China, whether typical real estate developments or leisure parks, has been made vastly more precise, with less need for extrapolation and estimation.

What’s also eye-opening is that this kind of analysis is possible in the first place. The power of location-based services and mobile phone tracking has always been known, but seldom in any other market have they been deployed in such a manner.

The ultimate impact this will have on future competition is up to anyone’s imagination. With such precise data available for any neighboring competitor or comparable, will this lead to real estate developers intensifying the competition or will it lead to a sort of renaissance, with new projects able to effectively identify and target underserved segments of the market?

*******

We hope you’ve enjoyed this extended preview. For exact figures, please consult the detailed reports available in our store.